Quality of Political Signals (Qindex)

In recent years, we have observed an increase in the prominence of words like fake news, half-truths, alternative facts, and suchlike in our modern vocabulary. Too often those words are used to describe politics in countries around world. It’s not surprising, then, that the quality of political signals has become more relevant than ever. In an environment of high-quality political signals, one may focus on the implications of messages from the centre of power, instead of the extent to which the messages themselves are reliable. But this is not the case when the quality of political signals is low.

We have constructed indices to measure the quality of political signals for the US and the UK using the methodology proposed by Baker, Bloom and Davis (2016). For a given period, our index (called Qindex) reflects the frequency of articles in leading nationwide newspapers that contain terms related to policy, signals, and quality. The higher the value of Qindex, the lower the quality of political signals. The proposed benchmark represents a scientific approach to the idea behind the Washington Post Fact Checker.

The constructed Qindices were used in our study (see Bialkowski, Dang and Wei, (2021)) to verify the implications of the theoretical model developed by Pastor and Veronesi (2013). We show that the historically strong and positive correlation between economic policy uncertainty and the CBOE VIX index was much weaker in the 2016–2020 period, due to low-quality political signals. We believe that our benchmark of the quality of political signals can be applied in other areas of the social sciences as well. Therefore, we aim to update and publish our data on a monthly basis.

Methodology

For each country, we examined a set of up to 10 leading newspapers based on their national circulation. Using the Factiva database, we scanned the digital archives of each newspaper to obtain a monthly count of articles containing the terms belonging to three categories: quality (e.g. “false”, “misleading”, or “ambiguous”), signal (e.g. “signal”, “declarations”, or “claim”), and policy (e.g. “deficit”, “legislation”, or “Federal Reserve”). The complete list of terms is available in our study, Bialkowski, Dang and Wei (2021). To meet our criteria, an article must contain terms in all three categories pertaining to quality, signal, and policy. Next, we scaled the raw counts by the total number of articles in the same newspaper for each month to deal with the issue that the overall volume of articles varies across newspapers and time. Next, we standardized each monthly newspaper-level series to unit standard deviation and then averaged across the 10 newspapers by month. Finally, we normalized the 10-paper series to a mean of 100 based on the same selected period.

Qindices

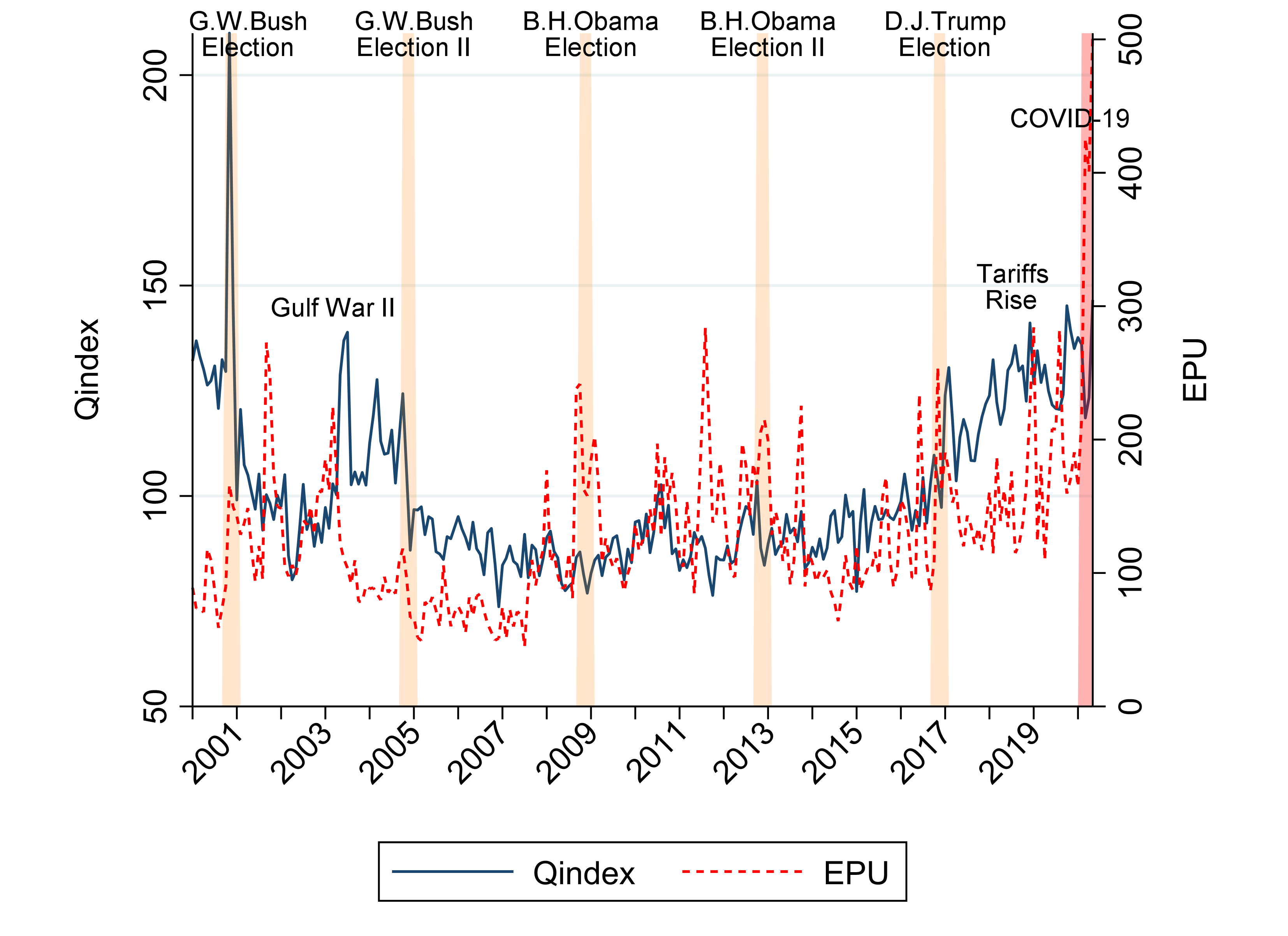

US Qindex

For the US data, we used the 10 leading newspapers based on their circulation: USA Today, The Washington Post, The Boston Globe, The New York Times, The Wall Street Journal, Tampa Bay Times, New York Post, New York Daily News, Star Tribune, and The Atlanta Journal Constitution. We scanned the digital archives of each US newspaper starting from January 2000 to obtain a monthly count of articles containing the following terms belonging to three categories: quality (e.g. “false”, “misleading”, or “ambiguous”), signal (e.g. “signal”, “declarations”, or “claim”), and policy (e.g. “deficit”, “legislation”, or “Federal Reserve”). The graph below presents the EPU index together with Qindex for the US for the period between January 2000 and May 2020.

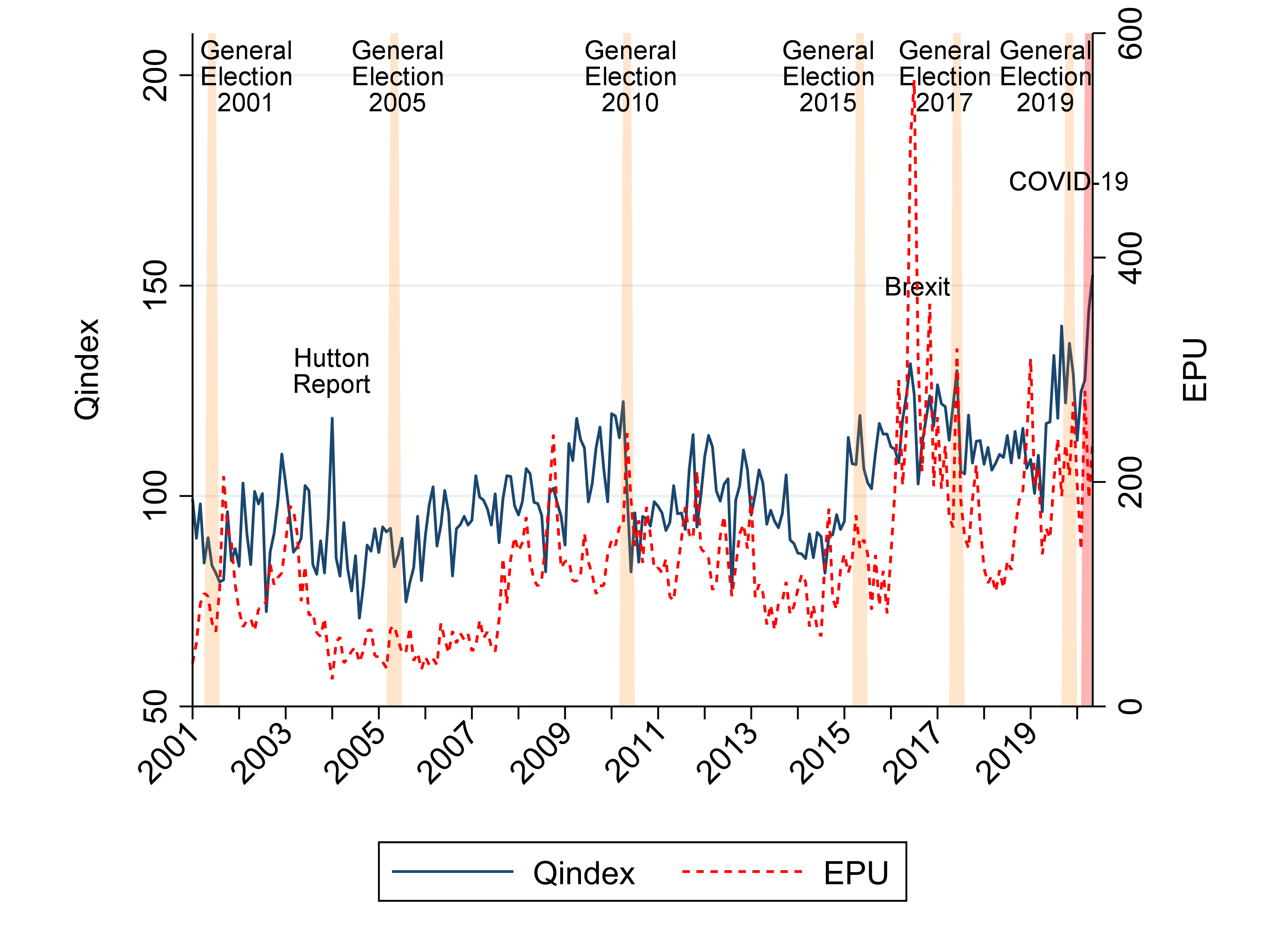

UK Qindex

For the UK data, we constructed a UK Qindex since January 2001. The 10 leading newspapers used for the UK Qindex includes Financial Times, The Times, The Telegraph, Daily Mail, Daily Express, The Guardian, Mirror, The Northern Echo, The London Evening Standard (former Evening Standard), and The Sun. The quality and signal terms remain the same as for the US market, but we adjusted the policy terms to reflect specifics of the UK political scene. The graph below presents the EPU index together with Qindex for the UK for the period between January 2001 and May 2020.

References

Jedrzej Bialkowski

jedrzej.bialkowski@canterbury.ac.nz

Jędrzej Białkowski (FRM, PRM) is a Professor and the Head of Department of Economics and Finance at the University of Canterbury, New Zealand. His research focuses on financial risk management and investments, including socially responsible investing. Since the early 2000s, he has had a research interest in the relationship between politics and capital markets which has resulted in important contributions to the literature. He was a visiting scholar/professor at McCombs School of Business, University of Texas at Austin and Saïd Business School, University of Oxford. He has published in top-ranked finance journals, the Journal of Financial Economics and Journal of Banking and Finance, as well as top outlets in the area of derivatives, the Journal of Derivatives and Journal of Futures Markets. Jedrzej is the recipient of the prestigious award, the Boyle, Lally, and Rose Cup, for best overall paper at the 2019 New Zealand Finance Colloquium.

Xiaopeng Wei

Xiaopeng Wei is a lecturer at the University of Adelaide, Australia. His research interests include investors’ sentiment, market volatility, behavioural finance, financial derivatives, policy uncertainty, and financial institutions. He is a graduate of Beijing Technology and Business University, with an MSc in Finance from Tilburg University. He received a Ph.D. in Finance from the University of Canterbury, New Zealand in March 2020.

Huong Dieu Dang

Huong Dieu Dang is a Senior Lecturer in Finance at the University of Canterbury. Her research interests include social norms, behavioural finance, credit risk, portfolio management, and financial institutions. Prior to joining the University of Canterbury, she was a post-doctoral research fellow at the Ludwig Maximilian University of Munich. She received an MBA and an MSc from the University of Arizona in 2006 and a Ph.D. from the University of Sydney in 2010. She is a CFA Charterholder and an Associate Editor of the Journal of Applied Accounting Research.